what is a provisional tax payment

When an Individual is Eligible For Provisional Payments. Provisional tax is not a separate tax from income tax.

Advice For Provisional Taxpayers Who Have Missed The Tax Deadline Maya On Money

Provisional tax is not a separate tax from income tax.

. It requires the taxpayers to pay at least two amounts in advance during the year of assessment. Everyone pays income tax if they earn income. Provisional tax is not a separate tax.

It is a method of paying the income tax liability in advance to ensure that the taxpayer does not. You pay it in instalments during the year instead of a lump sum at the end of the year. An individual and eligible spouse who request s expedited.

The main reason is to ensure the Taxpayer is not paying large amounts on assessment so is the tax. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on. Not EVERYONE pays provisional tax.

According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the. What is provisional tax. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the.

It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of. The Provisional Tax system is one of two main systems whereby the tax due for a particular year is collected during the same period in which income is. Being subject to provisional tax means that you will need to estimate your future income and make 3 payments throughout the financial year on a set schedule to ensure that youre paying.

What is Provisional Tax. Provisional taxpayers are basically individuals or companies who earn business income. To qualify for provisional tax as of the financial.

Provisional tax is not a separate tax. Your provisional income is a. What is the tax payment deadline for 2020.

The Internal Revenue Service delayed the tax filing and payment deadline for individuals to today May 17 from April 15 for 2020 tax. They do not pay tax on it until the end of the year. Youll have to pay provisional tax if you had to pay.

It is a method. Provisional tax is income tax you pay in instalments during the year. Provisional tax helps you manage your income tax.

Provisional tax is not a separate tax. Self Employed people rental property owners and people. Provisional income is a tool used by the IRS to determine whether youll pay federal income tax on part of your Social Security benefits.

First and foremost provisional tax is not a separate tax from income tax. What is the Provisional Tax System. Policy - Provisional Payment Eligibility.

Nov 29 2021. Provisional tax is tax you pay in advance. Provisional Tax is not separate tax it is only the method of paying tax that is due.

Provisional tax is not a special separate type of tax but simply a mechanism to pay your taxes during the tax year instead of having a large amount due to SARS on. It is a method of paying our relative income tax liability in advance to ensure that the taxpayer does not remain with a. This is done because.

Tax Accountant Tax Rates Income Tax Tax Facts Nobilo Co

Paye And Provisional Tax Payments 2007 2008 2016 2017 Download Scientific Diagram

Corporate Tax In Mexico What You Need To Know Start Ops

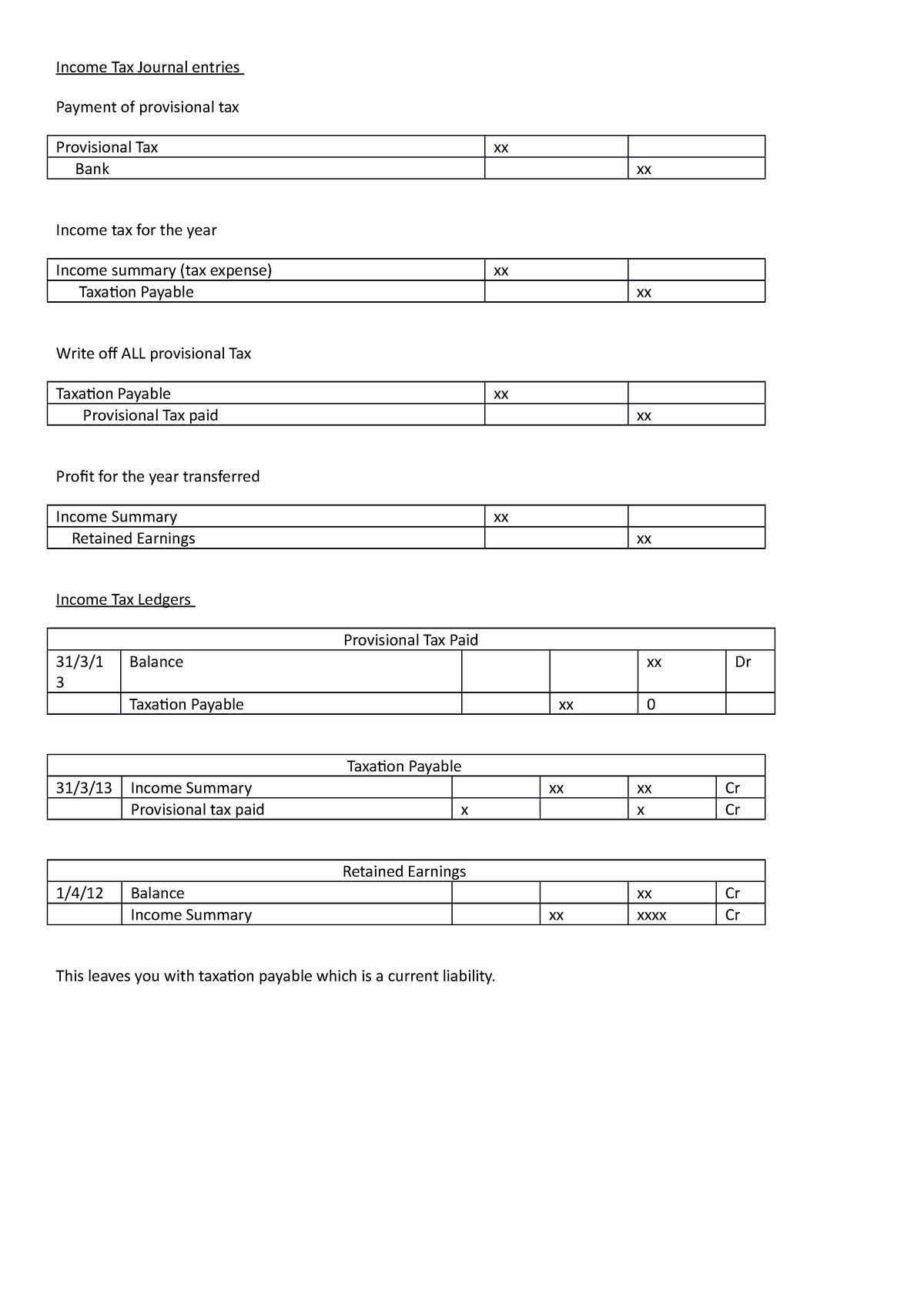

Templates For Journals And Ledgers Income Tax Journal Entries Payment Of Provisional Tax Studocu

Zimra On Twitter Public Notice Fourth Quarter Provisional Income Tax Payment Due 20 December 2021 Https T Co A7wz15r4yk Voluntarycompliance Mytaxworks Https T Co Eoj1fibvlb Twitter

The Impact Of Covid 19 On Provisional Tax Liabilities Rain Chartered Accountants

How To Calculate Provisional Tax Payments Guide And Calculator

Grade 12 Companies Ledger Accounts Lesson 2 Youtube

Provisional Tax Enhanced Tax Accounting

What Is Provisional Tax When Does My Company Pay It Gl Accounting Sa

Afxentis Zemenides Financial Services Ltd

Sa Revenue Service On Twitter An Example Of Provisional Tax Estimates Based On The Applicable Provisional Tax Payment Periods Yourtaxmatter Https T Co Uuz09vltoa Twitter

Solution Taxation For Accounting Studypool

Provisional Tax Who Is It For And When Should It Be Paid

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

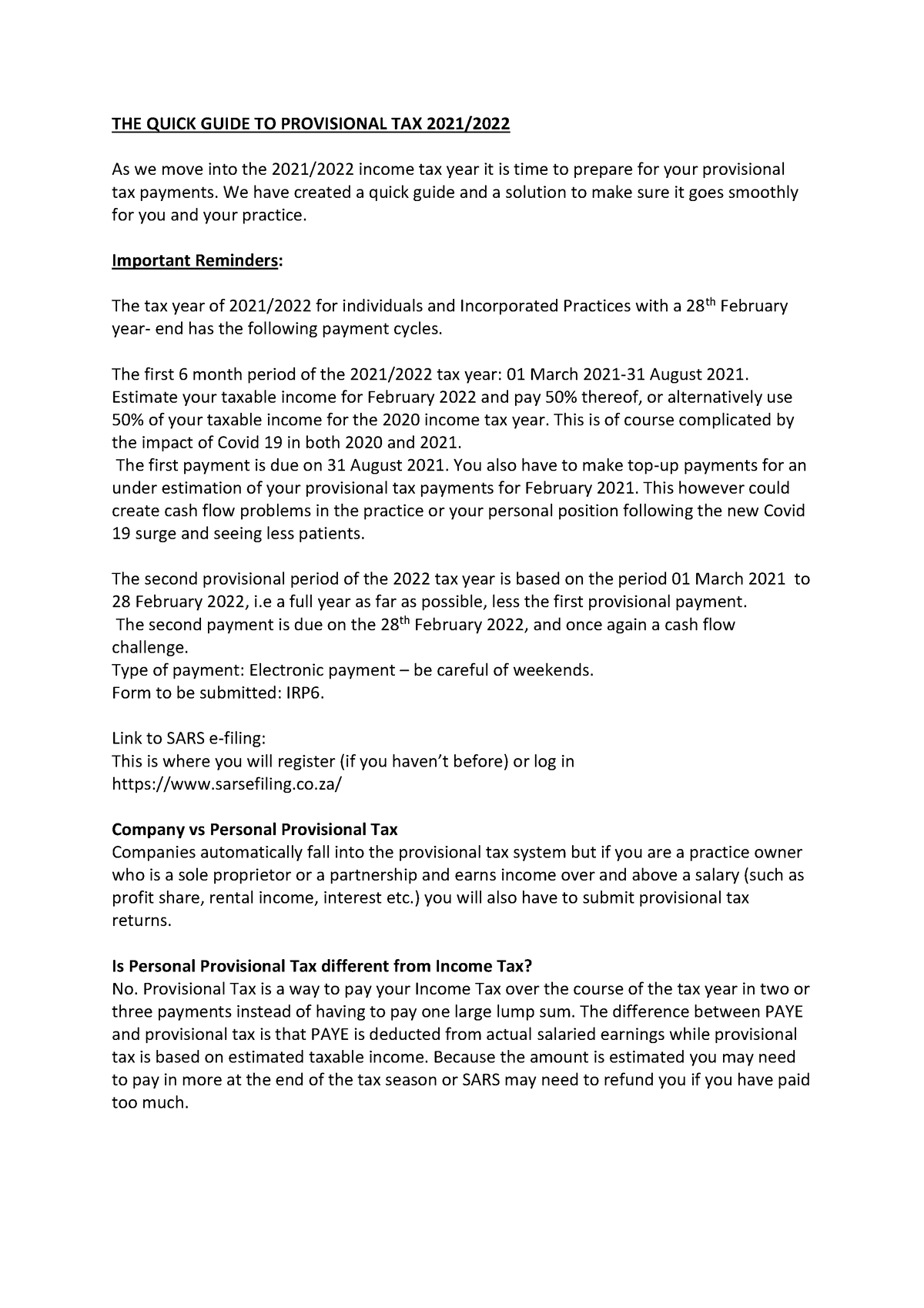

Provisional Tax Class Notes The Quick Guide To Provisional Tax 2021 As We Move Into The Studocu

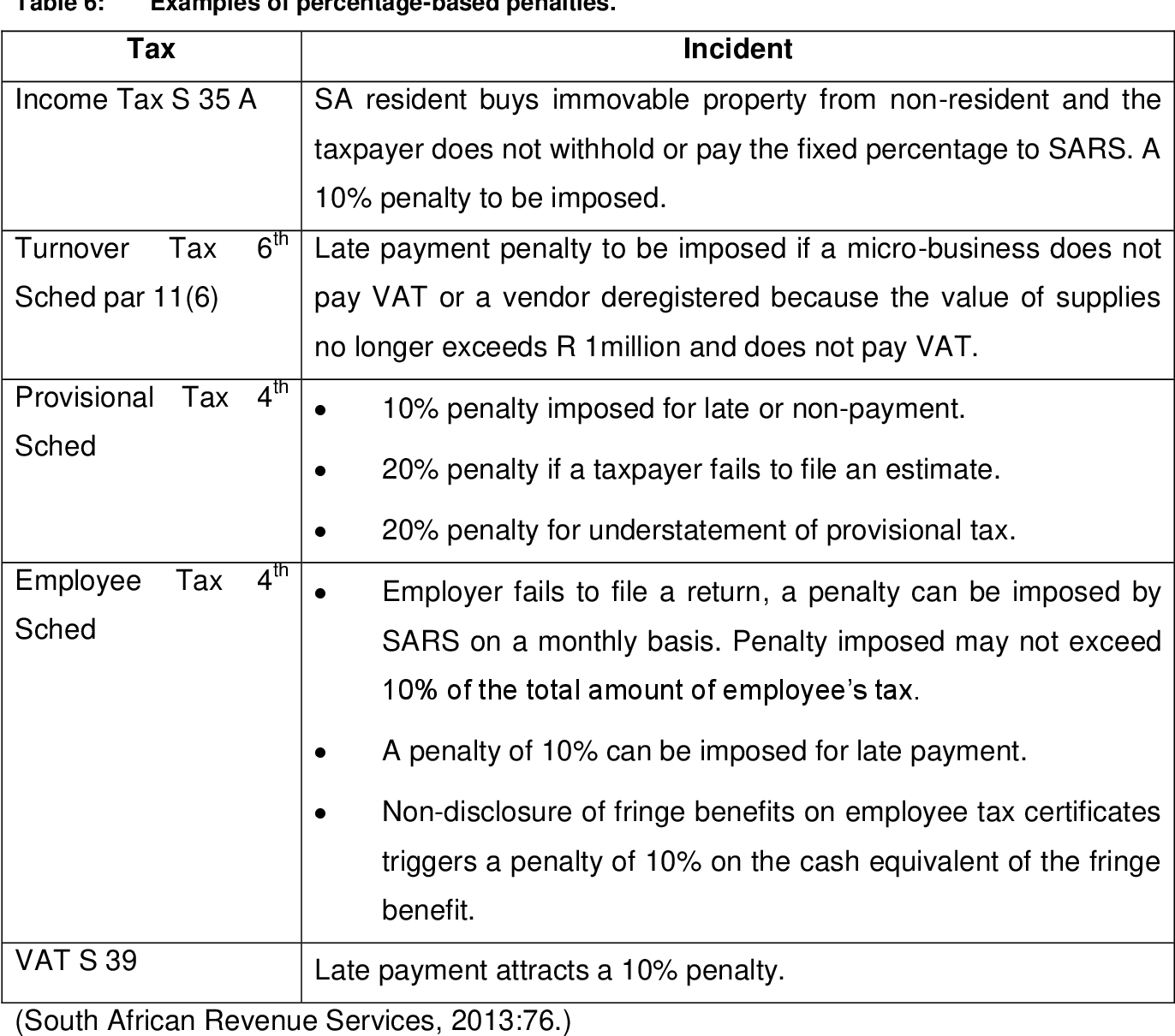

Tax Administration A Comparison Between Income Tax Act And The Tax Administration Act Assessments Objections Penalties And Interest Semantic Scholar